The Industrial Metaverse Convergence with Consumers

How industrial companies can launch consumer goods in the metaverse using blockchain technologies. More stories on grocery robotics rivals, spin welding, and moving large machine tools.

The business models of industrial companies typically revolve around producing a set of goods and providing service offerings alongside them. Whether the good is an automobile, a piece of apparel, or a computer chip some of these goods target consumer markets while others are supplied to another business. No matter which type of good, there is often significant financial and reputational risk in bringing a new product to market. The metaverse provides opportunities for industrial companies that produce consumer goods to reduce their product development risk, improve product quality, and maximize profits.

The Curious Case of Unisocks

The story of Unisocks dates back to 2019 when a now-popular blockchain app, Uniswap, launched a limited edition dynamically priced sock. This project introduced two critical concepts that will be explored further: a blockchain backed token linked to physical goods and redemption for a non-fungible token (NFT). They open the door for consumer-oriented industrial companies to launch products in a drastically different way.

A Blockchain-backed Token Linked to a Physical Good

Liam Frost at Decrypt wrote a great introduction discussing why the Unisocks project has reached a market capitalization over $20 million.

The original idea was that [the SOCKS token] is “backed” by the same amount of physical, limited-edition pairs of socks. But they also came with a unique price scale.

The very first SOCKS token was listed for $12, but the price of each subsequent sale has been increasing according to a dynamic curve since then. This has led to the current, absurd price high.

At launch, only 500 SOCKS were created. According to Coinbase there are only 302 SOCKS remaining in the circulating supply. Thus, 182 SOCKS have been redeemed for their physical counterpart. This all seems silly as the current price for a pair of Unisocks is roughly $120,000. However, being able to programmatically set a dynamic pricing or bonding curve can provide unique value to manufacturing companies investing new product development.

Non-fungible Token (NFT) Redemption

Over at DeFiPrime, Austin Ryan talks a bit more about the redemption mechanism of the SOCKS token.

When a SOCKS holder wants to redeem their token for a physical pair of Unisocks, the token is burned, reducing the number in circulation. While holders might be hesitant to burn their tokens to receive a nondurable good like a pair of socks, Uniswap incentivizes holders by sending them an NFT once they’ve redeemed SOCKS.

Unlike physical items, which really can’t be displayed to a large audience, the Unisocks NFT enables SOCKS redeemers to show their ownership across the internet, especially with platforms like OpenSea, and Lazy.com building out ways to showcase NFTs.

By redeeming the SOCKS token you not only get a physical pair of socks shipped to you wherever are in the world, but also you get digital property in the form of an NFT. The consumer can show off that they were indeed an early adopter of the product and help drive additional demand of the product.

Bonding Curves: Price Segmentation and Economies of Scale

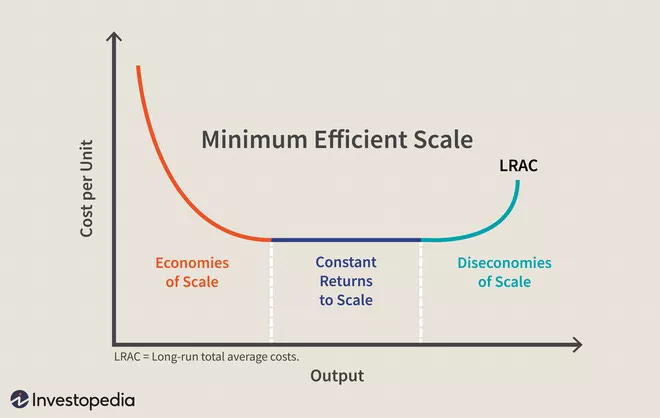

The first unit produced by a manufacturer takes into account all the research and development, machine tooling, and labor cost to design the product. These costs amortized over a single unit can be a fortune. Over time, the long-run average total cost is minimized if the product is successful and millions of the product are produced at scale. Investopedia’s definition on minimum efficient scale describes this in more detail.

While the cost per unit curve is not known in advance, it can be modeled, and when combined with the price bonding mechanisms as described in the Unisocks story, manufacturers could unlock better price segmentation for the initial units they produce. Unisocks used a exponentially increasing bonding curve, but that does not have to be the case. A manufacturer could launch a product with an exponentially decreasing price curve (like the orange part of the minimum efficient scale curve above) that declines over the first five hundred, thousand, or million units. If enough demand exists for the product, then development could commence and costs may be able to be recouped in totality.

Why would a consumer pay an exorbitant amount for the initial set of units? Price insensitive consumers often value being the first to own something, the early community, having something exclusive, and products personalized to their taste. Being first could grant access to behind the scenes development, decisions on product design, and lifetime access to follow on service offerings. Exclusivity worked out well for the Tesla Roadster and continues to this day with communities like the Tesla Motors Club. Lastly, manufacturers could offer some sort of personalization that illustrates the uniqueness of being an early backer of the product.

Metaverse Enabled Product Test & Evaluation

When redeeming the a physical product linked token, manufacturers could grant access the consumer access to an NFT that represents the designs of the physical product. The NFT could be used in the metaverse and the manufacturer could get early feedback on the product and learn about potential defects. Pre-launching a product that is still in a development (often referred to alpha or beta stages) is common in the digital product realm (e.g. SaaS, video games), but not in the industrial or consumer goods realm. By linking the physical world design to the real world-esque conditions in the metaverse, industrial companies can receive complex feedback about consumers tastes and product performance before moving further in the design cycle and incurring additional cost.

Launching Consumer Goods in the Metaverse

Consumer-oriented industrial companies that take advantage of the emerging opportunities of programmable blockchains and metaverses will be afforded business models with significant cost advantages. Unisocks led the way with some of the foundational concepts to link physical products to blockchain tokens with bonded price curves. By tapping into internet meme culture that exists in the metaverse, consumer goods companies could increase the likelihood of creating hit products and monetizing them to their fullest. The underlying blockchain technology is rapidly developing, but experiments like Unisocks show a glimpse of what is possible.

Assembly Line

Walmart is quietly preparing to enter the metaverse

Date: January 16, 2022

Author: Lauren Thomas

Tweet | Pocket | Instapaper

Walmart appears to be venturing into the metaverse with plans to create its own cryptocurrency and collection of non-fungible tokens, or NFTs. The big-box retailer filed several new trademarks late last month that indicate its intent to make and sell virtual goods, including electronics, home decorations, toys, sporting goods and personal care products. In a separate filing, Walmart said it would offer users a virtual currency, as well as NFTs.

Read more at CNBC

A remote village, a world-changing invention and the epic legal fight that followed

Date: January 27, 2022

Tweet | Pocket | Instapaper

The twisted tale of the battle between Norway’s AutoStore and the UK’s Ocado for robotic grocery picking supremacy.

Read more at Financial Times (Paid)

Spin Welding for Plastics Assembly

Date: February 1, 2022

Author: Jim Camillo

Tweet | Pocket | Instapaper

At the industrial level, spin welding technology for plastics assembly has made great strides in recent years. Long gone is the need to use a drill press to rotate one part against another. Manufacturers now use state-of-the-art machines with servomotors and sensors that provide full control over speed, acceleration and deceleration, and weld and hold time to consistently produce high-quality parts with super-strong welds.

Like any welding technology, spin welding has its market niche. Tier 1 automotive suppliers and manufacturers of filters and filter housings remain the biggest users of the process. Spin-welded automotive parts include durable under-hood parts like small elbows on manifolds, valves, tanks and bottles. Another application is welding extruded tubing to molded attachments for fuel filter lines.

Read more at Assembly

Heavy Engineering: The Complex Logistics of Moving Large Machine Tools

Date: February 4, 2022

Author: Brent Donaldson

Vertical: Machinery

Tweet | Pocket | Instapaper

One of our fascinations with large-format machine tools has little to do with their capabilities, but everything to do with the logistics involved with getting them up and running. Here’s how one of the world’s oldest builders of giant machine tools, Waldrich Coburg, tackles the challenge.

“Most of our most challenging transport situations don’t involve relocating a machine from an existing facility to a new one,” he says, “but are instead customers that bought a used piece of equipment.” It is not uncommon that these used machines — machines that are intended to last a lifetime — need to be retrofitted with new controllers or spindle units, then moved to a storage facility while the customer works on the foundation.

Read more at Modern Machine Shop

A combinatorial auctions approach to capacity sharing in collaborative supply chains

Date: February 4, 2022

Author: Jonas Christoffer Villumsen

Tweet | Pocket | Instapaper

Collaboration among multiple parties throughout the supply chain may improve resilience. In collaborative supply chains bilateral agreements between buyer and supplier are replaced or supplemented by multilateral agreements. Three major complications for multi-party collaboration in automotive supply chains arise. Existing bilateral contracts must be respected, procurement of parts needs to be bundled, and the delivery of parts is constrained temporally, to ensure available production capacity and minimize inventory.

Read more at Industrial AI Blog

Surge Demand

Robots begin to take on new tasks with only simple instructions. Medtronic’s Hugo surgical robot debuts in Europe. Tesla’s Fremont factory is the most productive auto plant in North America. BioCina has opened Australia’s first bacterial cell-based manufacturing facility in Adelaide.