Paying for Defects in Leading Edge Manufacturing

Apple will only pay for working chip dies from TSMC for the iPhone A17 chip, is that unique? Automotive and commercial aviation OEM-Supplier dynamics give clues.

Some semiconductor observers were astonished when The Information reported last week how Apple will save billions of dollars on chips for the new iPhone with one outlet even calling it a ‘sweetheart deal’. The deal refers to Apple’s unique relationship with TSMC for the A17 Bionic chip powering next generation iPhones. For the A17 Bionic, it requires leading edge fabrication (3nm) which only TSMC (N3) and Samsung (SF3) are currently able to execute. In the terms of the deal, Apple will only pay for working chip dies rather than the traditional arrangement where a fab, TSMC, makes wafers to a specification and the designer, Apple, incurs the cost of any unusable chip dies.

Read how many silicon chips are there on a 300 mm wafer for an understanding on how many chips can fit on wafer.

To my surprise given the recent buzz, industry analysts had already discussed this arrangement back in April. As Brett Simpson of Arete Research puts it,

Apple will pay TSMC for known good die rather than standard wafer prices, at least for the first three to four quarters of the N3 ramp as yields climb to around 70%. “We think TSMC will move to normal wafer-based pricing on N3 with Apple during the first half of 2024, at around $16-17K average selling prices,” Simpson said. “At present, we believe N3 yields at TSMC for A17 and M3 processors are at around 55% [a healthy level at this stage in N3 development], and TSMC looks on schedule to boost yields by around 5+ points each quarter.”

For the iPhone A17 chip, TSMC will do 82 mask layers with a die size likely in the 100-110 mm square range, the Arete report said. That means a yield of around 620 chips per wafer with a wafer cycle time of four months, the report added. M3 is likely to be around 135-150 mm square die size and around 450 chips per wafer, according to Arete.

The levers of the deal include a few variables regarding defect rate, wafer cycle time, wafer size, and die size similar to this homework question. So, are these deal terms truly unprecedented?

Supply Risk Sharing in High Tech Endeavors

Apple is reported to have bought out all of TSMC’s N3 capacity for the next year and is already responsible for nearly a quarter of TSMC’s revenue. With Apple being the essentially the sole launch customer on a brand new manufacturing process, there is significant risk in missing deadlines for the annual iPhone launch. Apple needs TSMC N3 yields to be high enough or else they won’t be able to assemble the 200 million iPhones demanded, impacting a hundred billion dollar opportunity. At the same time, TSMC seeks to reduce the risk of developing a new fabrication process that costs tens of billions, which if it goes wrong could lead to financial ruin, for essentially a single customer and product. However, there are many current and prior OEM-Supplier relationships that mimic the dynamics of Apple and TSMC and they can be found in commercial aviation and automotive.

The Sporty Game of Commercial Aviation

Similar to semiconductor design and fabrication, commercial aviation platforms are extremely high-risk to design, develop, and certify. Among my favorite books, “The Sporty Game: The High-Risk Competitive Business of Making and Selling Commercial Airliners” goes in-depth to the high-risk investment required to make a new commercial airliner during the early aviation age. The lessons from that period live on to this day with the two most recent widebody platforms developed, Boeing’s 787 and Airbus’ A380, each incurring over $20 billion in development costs. Even more recently, China’s COMAC C919 narrowbody airliner has been in development for 15 years, is still not certified outside of China, and has incurred costs around $49 billion.

Unlike semiconductors, where some partially failed dies can be re-binned and sold as lesser SKUs, all airplanes must always meet strict regulatory standards. The fabrication of certified airplane assemblies remains highly technical, but largely manual, and defects can lead to significant financial impairments (see last week’s post on RTX engines). One aerostructures supplier, Spirit AeroSystems, a spinoff from Boeing, faces similar risks to that of TSMC.

Spirit AeroSystems’ Tangled Relationship with Boeing and Airbus

Spirit AeroSystems is one of the world’s largest manufacturers of aerostructures for commercial airplanes, defense platforms, and business/regional jets. With expertise in aluminum and advanced composite manufacturing solutions, the company’s core products include fuselages, integrated wings and wing components, pylons, and nacelles.

Spirit AeroSystems delivers up to 500 fuselages per year to two customers: Boeing and Airbus. While the unit volume does not compare to the 200+ million chips TSMC needs to produce for Apple, the fuselage is just as important to an airplane as a chip is to an iPhone. Also, Spirit’s extreme customer concentration, high manufacturing development costs, and customer opportunity costs if they fail to deliver quality products puts them in a very similar predicament to TSMC.

In their most recent quarterly results, we see the consequences when manufacturing quality risks materialize:

Spirit notified Boeing of a quality issue identified on the vertical fin attach fittings of certain models of the 737 fuselage that Spirit builds. Spirit has performed a preliminary financial assessment of the potential impacts. As a result, the Company expects disruptions and rework within Spirit’s Wichita factory to negatively impact full-year gross profit by $31 million, of which $17 million is reflected in the first quarter 2023 financial results. Additional costs are expected, including costs Boeing may assert to repair certain models of previously delivered units in their factory and warranty costs related to affected 737 units in service. The impact will be based on a unit-by-unit analysis. However, the Company cannot reasonably estimate the remaining potential costs at this time. Spirit will continue to evaluate the situation and coordinate closely with Boeing to minimize the impacts.

We also see, which has not been seen yet in the case of Apple and TSMC, that the customers understand the reliance on their supplier and are willing to arrange payment terms to keep them afloat during the hard times:

After the balance sheet date of March 30, 2023, [Spirit] entered into agreements with certain customers to provide cash advances totaling $280 million, based upon certain agreed upon performance criteria, which the Company expects to receive in the second and fourth quarters of 2023. The Company will receive an advance of $230.0 million in the second quarter, $180.0 million of which is from Boeing. These advances will require repayment of $90.0 million in 2024 and $140.0 million in 2025. The Company expects to receive an incremental advance of $50.0 million by the end of the fourth quarter, which will require repayment in 2025.

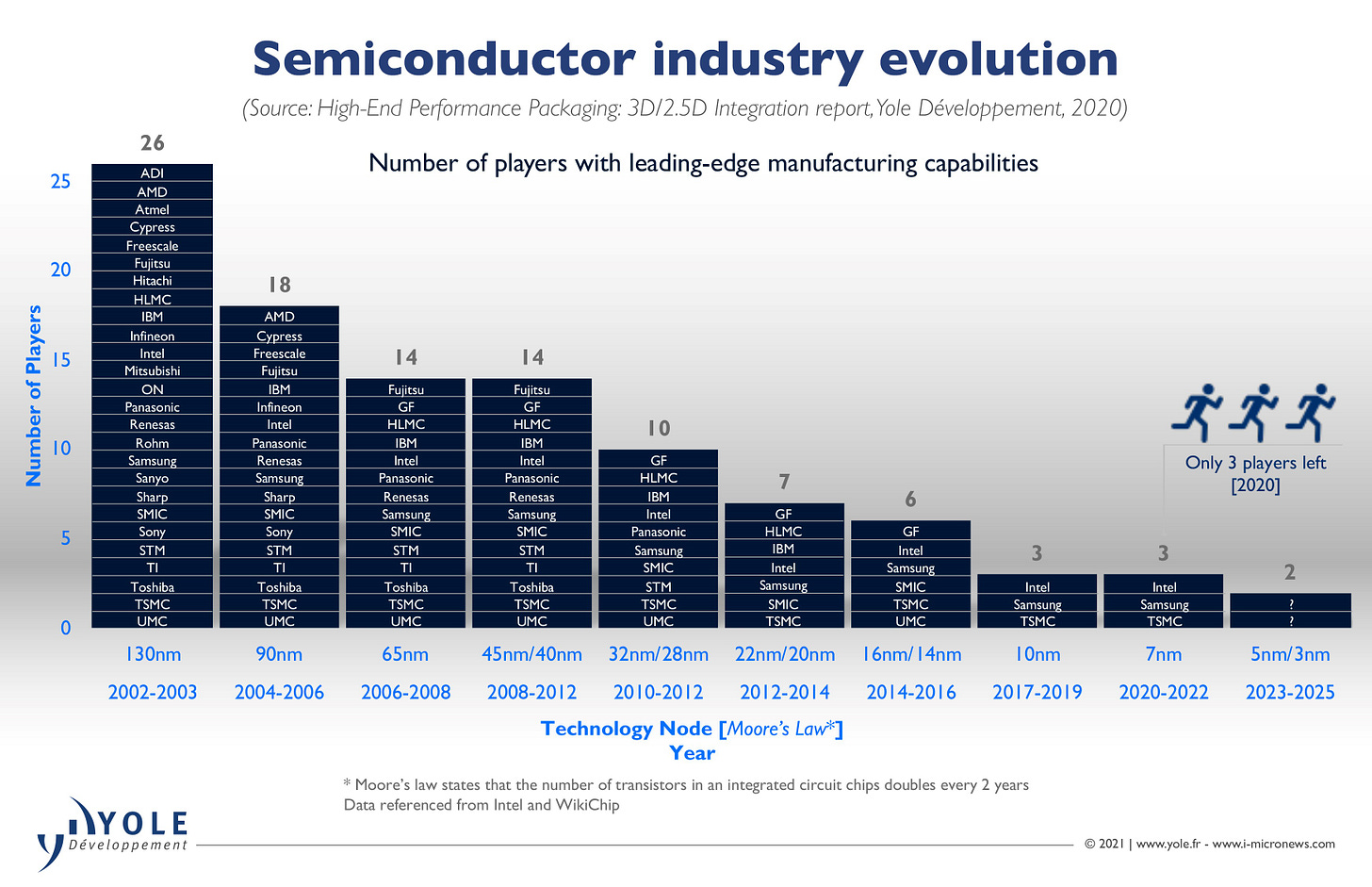

It doesn’t appear the structure of the semiconductor industry is yet as fragile as the commercial aviation industry, but the semiconductor industry has been been tending toward fewer companies with leading-edge manufacturing capabilities for decades. Leading-edge semiconductors may inevitably result in more deals structured with unique terms similar to Boeing/Airbus and Spirit. This Apple and TSMC deal could simply be a preview of future deals to come because of the concentration aspects.

The Consumer Good Similarities of Automotive Assemblies

Collectively, automotive OEMs also share many similarities to Apple but with more variety in supply base. They have similar level of scale in terms of units produced and product complexity with yearly product cycles. Any supply chain disruptions leads to costly downtime in final assembly and missed sales. To manage this complexity, automotive supply chain relationships have become part of the competitive differentiation for auto OEMs. They’ve dreamed up almost every sort of supply arrangement and partnership possible but still, risks materialize, leading to irreparable brand damage that Apple cannot not let occur.

Peter Klibanoff and Sharon Novak studied “Contracting, Directed Parts, and Complexity in Automotive Outsourcing Decisions” back in 2003 and found that,

an increase in [product] complexity drives bids up by about 43%, and the presence of directed parts increases the bid price by approximately 31%… and directed parts and complexity serve as strongly negative substitutes in the determination of the equilibrium bid price, and this effect is so strong that it can even counter the individual effects on pricing.

In other words, the study concludes the cost savings due to directing parts may be less than the drawbacks resulting from a quality shortfall and that many of the contracts they studied had quality provisions just like Apple’s deal with TSMC.

Definition of directed parts: The customer directs parts from a sub supplier to be integrated into a system sourced from a different supplier. The supplier integrating the directed part is responsible for the quality of the directed part. Note, an Apple chip design to be produced by TSMC is considered a directed part.

Automotive platforms are undergoing a rapid transition to fully electric propulsion systems. The innovation dynamics in battery technology and manufacture are similar to as TSMC’s semiconductor fabrication processes. Research by Yuru Zhang looked at passive keyless entry (PKE) and high-speed transmission (HST) on automobiles between the model years 2004 and 2021 in “Innovation Dynamics Between Original Equipment Manufacturers (OEMs) and Tier-1 Suppliers in the Automotive Industry.” He found,

the empirical studies validate the hypothesis that the outcomes of competitive and collaborative behaviors on the whole product competitiveness depend on market competition, which is reproducible by the model: when the market is stable, the more competitive party in a relationship has a better financial outcome; when the market is highly competitive, collaborative behaviors boost the long-term performance of the OEM-supplier ecosystem.

Automotive OEMs and their battery suppliers are setting up joint ventures at record pace to formalize collaboration and hope to make it out the other side of this platform shift. While Apple and TSMC have a stable (or at least mature) smartphone market that passenger vehicles was 10 years ago. Apple is currently the more competitive party driving TSMC to 3nm while securing what initially appears to be the better financial outcome.

Supply Chain Management is All About Sharing Risks

Far from a sweetheart deal, Apple is ensuring they are able to supply their customers and limit their downside if TSMC is unable to produce, like automotive manufacturers have done in the past. For TSMC there are manufacturing risks lurking around every corner that can bankrupt you due to customer concentration, like airliner assembly. Shrewd supply chain managers are always assessing the dynamics of the supply relationships and considering joint outcomes. Apple needs TSMC to be successful and vice versa. Their new arrangement reflects long-studied OEM-Supplier dynamics and their relationship will evolve in the future as manufacturing technology matures and consumer demand changes perhaps just as Brett Simpson expects.